Value investors often overlook paper companies, but JK Paper’s strong financials tell a different story. With value acquisitions and cost advantage, the company has built a strong foundation. But rising wood prices and import pressures could test its resilience.

Few investors dream about investing in paper companies. It’s not the kind of sector that gets discussed around coffee tables or makes headlines. But value investing isn’t about what’s exciting; it’s about what’s quietly working.

Take India’s top three pure-play paper companies: JK Paper, West Coast Paper, and Seshasayee Paper. Over the past decade, they’ve quietly grown profits at annualised rates of 35%, 50%, and 25% respectively. Part of that growth comes from consolidation — a global trend. A BCG report states that between 2000 and 2023, mergers and acquisitions in the global paper industry consistently totalled $15-25 billion annually.

JK Paper knows this playbook well. Its recent acquisitions in corrugated packaging, particularly over the last three years, has catapulted it to become the largest player in the segment.

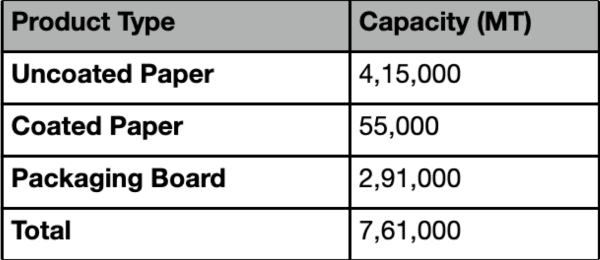

Today, JK Paper stands at a total capacity of 7,61,000 MT with packing accounting for 2,91,000 MT.

Why corrugated packaging?

The answer is simple and compelling: India’s e-commerce and quick commerce markets are booming. Explosive growth in online shopping has created an enormous demand for packaging that’s not just cost-effective but also durable and sustainable. Corrugated boxes fit perfectly into this narrative. Not to mention, compared to plastic, paper is environmentally friendly if tree plantations and cutting are done in a sustainable manner.

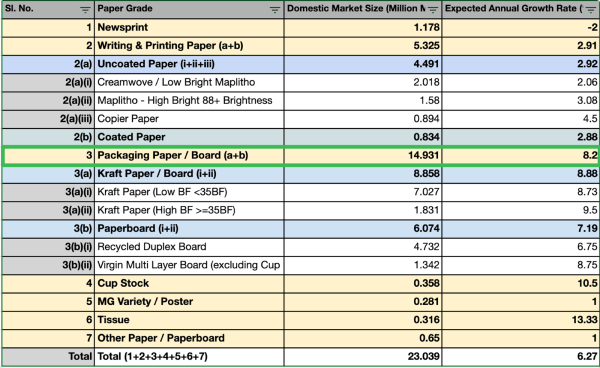

According to the Indian Paper Manufacturers Association (IPMA), packaging paper and board segments are expected to grow at a robust 8.2%.

The Federation of Corrugated Box Manufacturers (FCBM) is even more optimistic, forecasting 10-12% growth, making it one of the fastest-growing segments within the paper industry.

But then comes the tough part

Paper is fundamentally a commodity. JK Paper’s A4 sheets aren’t fundamentally different from BILT’s (which went bust) or Century’s copier paper. Commodity pricing is relentless; it doesn’t care about brand. So, success boils down to something less flashy but more important: cost efficiency.

Source: Indian Express